Equipment Financing

FINANCE EQUIPMENT WITHOUT UPFRONT COSTS

Equipment Financing provides businesses with the means to acquire essential equipment without the burden of upfront costs. This solution allows companies to spread payments over time, ensuring they can invest in the tools needed to grow and remain competitive while preserving cash flow.

FINANCING EQUIPMENT FOR BUSINESS SUCCESS

Equipment financing enables businesses to acquire essential tools and machinery without the upfront financial burden. By spreading payments over time, companies can maintain their cash flow while investing in critical resources that drive growth and operational efficiency.

Businesses often face the challenge of balancing their need for modern equipment with the financial constraints of large capital expenditures. Equipment financing provides a solution by allowing companies to access the resources they need without compromising their financial stability. This approach ensures organizations can stay competitive in their industries while preserving their working capital for other priorities.

It is particularly beneficial for companies looking to scale their operations or replace outdated equipment. With flexible repayment plans and competitive interest rates, businesses can tailor their financing agreements to meet their specific needs. This flexibility helps organizations maintain a balance between short-term costs and long-term growth.

As industries evolve and new technologies emerge, businesses must stay ahead of the curve. Equipment financing offers a strategic way to upgrade machinery, adopt cutting-edge technology, or expand operational capacity. By minimizing upfront costs, companies can allocate funds to other critical areas, such as hiring talent, marketing, or research and development.

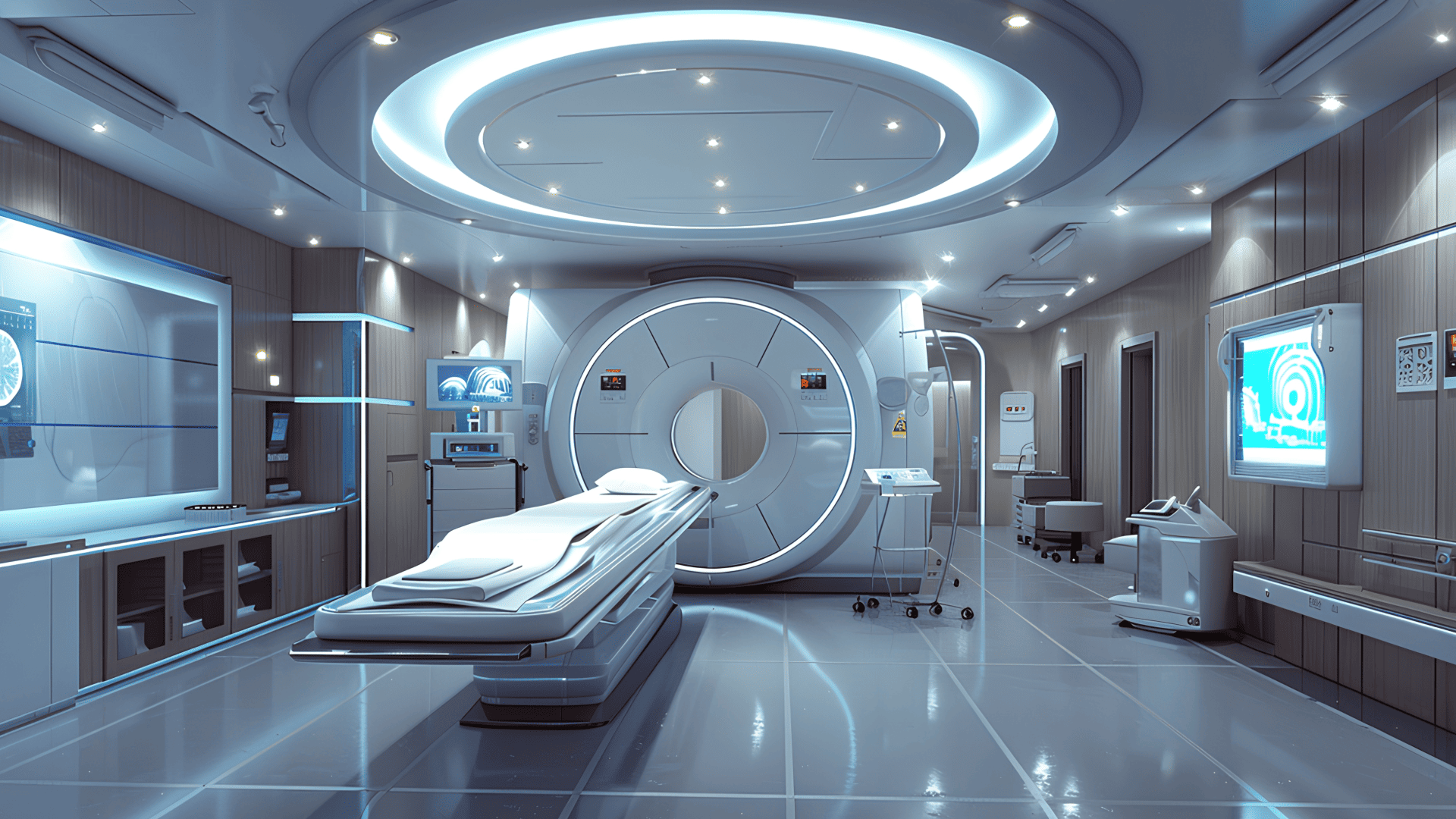

Equipment financing supports businesses across various industries, from construction and manufacturing to healthcare and technology. It ensures that organizations can access the tools they need to succeed, regardless of their size or sector.

Partnering with the right financing provider is key to ensuring a seamless process. From understanding the terms of the agreement to evaluating the total cost of ownership, businesses can make informed decisions that align with their goals.

By leveraging equipment financing, businesses gain the opportunity to innovate, grow, and succeed in an ever-changing marketplace. It’s more than just funding—it’s a step toward sustainable success and competitive advantage.

FAQs

Equipment financing allows businesses to acquire equipment by spreading the cost over manageable payments. Instead of paying the full amount upfront, you make monthly installments, enabling you to use the equipment immediately while maintaining cash flow.

Most business-related equipment, such as machinery, vehicles, technology, and tools, can be financed. This includes both new and used equipment, depending on your industry and specific needs.

In most cases, the equipment being financed serves as collateral. This means you don’t need additional assets to secure the loan, making it a convenient option for many businesses.

Equipment financing helps preserve working capital, provides access to the latest tools, and offers flexible payment terms. It ensures businesses can scale operations and stay competitive without the burden of large upfront costs.